Our experts consider ApolloFinances to be a reputable global online brokerage. The broker aims to provide a wide range of instruments, all under one roof, serving clients around the globe. ApolloFinances is based in the Marshall Islands, and is owned and operated by MGX Consalt Group Ltd, which is registered in the Marshall Islands under registration number 106986, with its headquarters on Ajeltake Island, Majuro. It is important to note that offshore brokers such as ApolloFinances are not subject to licensing or authorisation by major regulating bodies such as the FCA, though they do, of course, have to abide by all local laws and restrictions. ApolloFinances displays all its legal documents and disclosures clearly on its website. The legal documentation published by this broker is easily found by going to the ‘Company’ tab on the main website, and selecting ‘Documents’ from the drop-down menu. There, you will find a long list of published legal documents, including details of the firm’s Terms and Conditions, Privacy Policy, and Risk Warning Document. You will also find other important information, such as the firm’s anti-money laundering policy, the bonus agreement, and a customer complaint form, should you ever need it.

Our experts were pleased to see that ApolloFinances also offers a new customer bonus, though the details of the bonus available change from time to time, so always check the most up-to-date details, which can be found on the website. Read the bonus agreement carefully before claiming the bonus as it is subject to various terms and conditions. Also, there are trading volume requirements to be met before your bonus and any trading profits from that bonus can be withdrawn. The company offers a risk-free trade to new clients, allowing those who make a minimum approved deposit of between $2,000 and $10,000 to claim a refund if they make a loss on that trade. Again, this promotion is subject to terms and conditions, so check the details carefully to be sure that you meet the conditions and claim the refund, if it applies to you, within the specified time frame.

Broker Summary

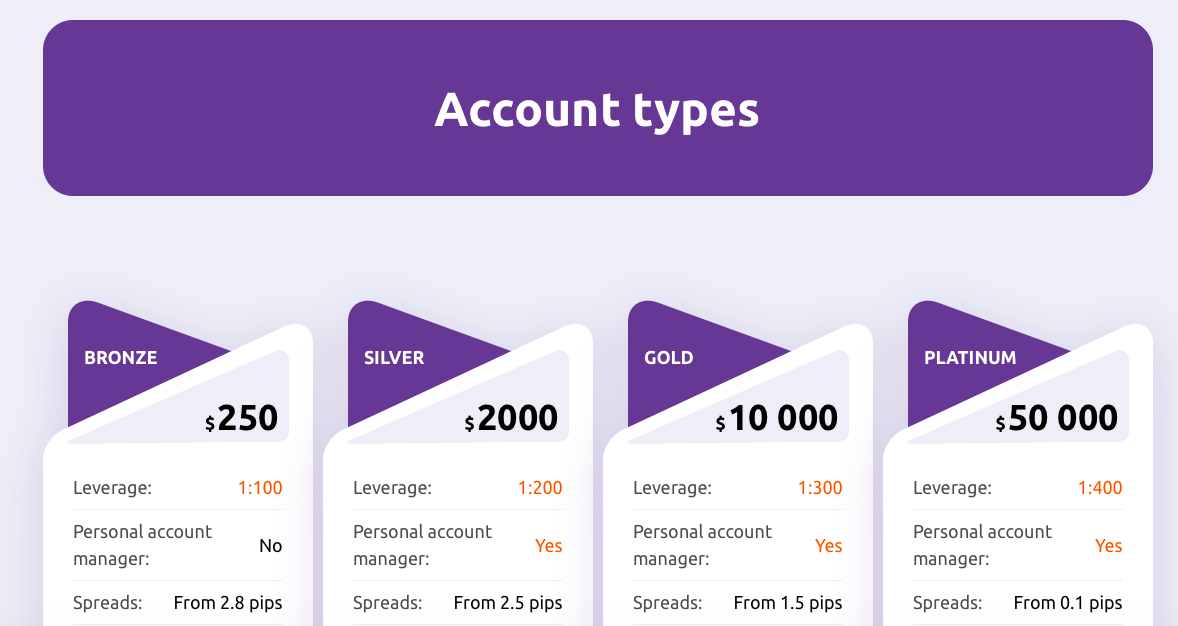

ApolloFinances has a range of features and offerings that will make it an attractive option to many online traders at all levels of experience. Known predominantly as a forex and CFD brokerage, the company offers a wide range of financial instruments across multiple asset classes, allowing clients to trade Currencies, Indices, Futures, Shares, Metals, CFDs, and Energies. The broker offers generous leverage and competitive spreads. There is an excellent choice of account types, with all but the basic Bronze account offering access to a personal account manager. Opening and verifying an account with ApolloFinances is a very quick and easy process that is carried out completely online. Verification is, of course, required to prevent fraud and money laundering, but it is carried out fairly quickly, and simply requires you to upload your documents to verify your identity. Your information is securely encrypted and protected. There is also a good choice of options when it comes to funding your account, and making a deposit is straightforward. ApolloFinances also offers an award-winning trading platform in the form of MetaTrader 4 (MT4), which is available in various versions, allowing for web, desktop and mobile trading.

Some of the broker’s strengths include:

- 100+ trading assets

- Leverage up to 1:400

- Multiple deposit methods

- The world’s leading trading platform

Broker Intro

ApolloFinances is an online, multi-asset, offshore broker based in the Marshall Islands. The firm was founded in 2020, and offers more than 100 financial instruments. Customers have a choice of four different account types, each offering a range of features and attractive trading conditions. The Bronze account, which has a minimum deposit of $250, offers spreads from 2.8 pips and leverage of up to 1:100. The Silver account, with a minimum deposit level of $2,000, offers spreads from 2.5 pips and leverage of up to 1:200. For the Gold account, traders will need a deposit of at least $10,000, and can then access spreads from 1.5 pips and leverage of up to 1:300. Lastly, the Platinum account is for more advanced traders, with a minimum deposit of $50,000, spreads that start from as low 0.1 pips, and leverage of up to 1:400. Platinum account holders also benefit from a free VPS, and all Silver, Gold and Platinum account holders get their own personal account manager. All accounts come with access to markets around the globe, MT4 trading and Expert Advisors for easily customised automated trading. ApolloFinances offers trading via contracts for difference (CFDs), allowing traders to speculate on the price movement of a financial instrument, and potentially profit from that price movement, without ever owning the underlying asset. It should always be remembered that CFD trading can be risky, especially for beginners, so it is vital to educate oneself and trade with appropriate levels of leverage. The website provides clients with plenty of information about the assets it offers, and its trading platform, to ensure that they get the most out of their investing.

Spreads & Leverage

The spreads and leverage that you are offered as an ApolloFinances customer will depend on the type of account you open, as well as the financial instruments you choose to trade. The brokerage offers competitive spreads, starting from just 0.1 pips on the premium Platinum account, though this rises to 2.8 pips on the basic Bronze account. Like many other online brokers, ApolloFinances uses floating spreads, which means that the spreads change frequently, based on market conditions, and are sometimes very different from those advertised. It is vital that traders carefully monitor changes in spreads and also in market conditions that may affect them. At times of high volatility, it is normal for orders to be executed with a different spread from that stated when the order is placed. This is known as slippage, and is something that every trader needs to be aware of. Leverage also varies between accounts, and may be different for different instruments. Leverage offered on minor or exotic currency pairs, for example, is invariably lower than that offered on major pairs. Leverage at this brokerage is very generous, ranging from 1:400 on the Platinum account, down to a still significant 1:100 on the Bronze account. High leverage offers a lot of exciting opportunities for experienced traders, but we urge newer traders to educate themselves, and set their own level of leverage at one that is appropriate to their level of experience and appetite for risk.

Platform & Tools

ApolloFinances offers the award-winning MT4 trading platform, designed by MetaQuotes Software, in all its versions: for desktop, web and mobile, for both PC and Mac, and for both Android and iOS systems. MT4 trading offers a great deal of flexibility and allows traders to customise their trading experience, incorporating a range of resources to help users evaluate markets and manage their trading activities. The platform offers opportunities for highly personalised automated trading via Expert Advisors, which allows traders to choose the conditions under which trades will be executed, and put automations in place to enable positions to be opened and closed by the software. MT4 also allows for easy integration of a wide variety of trading tools, including technical indicators, integrated fundamental analysis, customised alerts, charting tools, and more. The MT4 software is widely used and highly respected among forex and CFD traders worldwide. It has a clean, intuitive and highly customisable interface, and is designed to be adapted to the specialised needs of individual traders.

Commissions & Fees

Trading at this broker, as at many CFD brokers, is mostly commission-free, with the broker’s profits coming from the spreads. This always sounds like an attractive proposition, except that it can make calculating the exact costs of trading more complicated, especially during periods of high volatility when spreads are changing frequently, and may be much higher than the minimum possible spread quoted for each account. Traders will need to keep a close eye on the spreads displayed via the platform while trading. It is also important to note that spreads across different asset classes will vary greatly. A multi-asset broker such as ApolloFinances can be a great idea for those who want the option to trade multiple asset classes, all in one place. However, you should keep in mind that you will need to check the spreads on all the different assets you want to trade in order to ascertain if ApolloFinances is the best broker for you. As with any broker, you will find some ‘hidden’ extra fees. One to be aware of is that when it comes to withdrawing funds, there is a standard $20 fee for bank wire transfers, or a fee of 25 units of the original currency of the initial deposit levied on bank transfers of less than US$500. As with any broker, fees are subject to change, sometimes at short notice. There may be other fees that apply to your account that are not mentioned in this ApolloFinances broker review.

Education

Many online brokers provide a wealth of educational resources for their potential and existing clients. Education, however, is one area where ApolloFinances provides only limited resources. There is not a dedicated education section available via the platform, though it is fair to say that there is a lot of information provided via the website that will be useful to traders. For example, each asset class has a page on the website explaining exactly how trading in that asset class works, what the implications of trading CFDs for that asset class are, and important points to be aware of. Customers are also encouraged to get in touch by emailing [email protected] with any questions they may have about trading that particular asset. The broker also provides a handy MT4 guide, which answers common questions that new users of the platform might have, from how to alter or delete a pending order, through to how to change your time zone or update your password. The lack of education at ApolloFinances might be seen by some as a drawback, but there is so much free and affordable information available online about forex and CFD trading that we would never rule out a particular broker based on this alone.

Customer Service

One of the more important things to consider when choosing a new brokerage is the quality of the customer service available. When trading exclusively online, it can feel very important that you are able to contact your broker at any time and receive a prompt reply to any questions or concerns you may have. ApolloFinances offers a choice of customer service channels for both new and existing customers, including a dedicated email address for customer support issues, a customer support phone line, and a handy web form that can be quickly filled in online. This web form, along with details of all support channels available, can be found on the contact page of the website. Remember that once you are signed up for a trading account at ApolloFinances, you will also be assigned a personal account manager, who you can contact directly with any questions or concerns.

Final Thoughts

As our in-depth ApolloFinances broker review has shown, this brokerage has a great deal to recommend it, with more than 100 financial instruments to choose from, across a range of asset classes, and an excellent choice of account types, depending on your needs and your budget. Spreads are competitive, and leverage is very generous indeed – up to 1:400 on the premium account. MT4 trading is available, which, of course, allows for customised automated trading, easy mobile trading, and a high level of functionality, along with compatibility with other tools and systems. A minimum deposit of just $250 makes this broker very accessible.

One drawback of this broker is the lack of an education section, though this alone would not prevent us from recommending the broker. There are also fees on some withdrawal methods, which needs to be considered, and can be avoided, as long as you are aware of them. All accounts come with access to a personal account manager, and most have Expert Advisors for automated trading. While we urge all traders to exercise caution when trading with offshore brokers, ApolloFinances is certainly a brokerage to consider, with a range of attractive features for both inexperienced and more advanced traders.

Broker Details

- Main products offered: Forex, CFDs, Futures, Shares, Metals, Energy Commodities, Indices

- Platinum account: From 0.1 pips/1:400 leverage/min deposit $50,000

- Gold account: From 1.5 pips/1:300 leverage/min deposit $10,000

- Silver account: From 2.5 pips/1:200 leverage/min deposit $2,000

- Bronze account: From 2.8 pips/1:100 leverage/min deposit $250

- Regulators: Locally regulated

- Leverage: Up to 1:400 depending on account type

- Eur/USD Spread: From 0.1 pips depending on account type

- Pairs: 45+

Platform: MT4 - Founded: 2020

- Country: Marshall Islands

- Phone to support: +442030974723

- Web Trading: Yes

- Mobile Trading: Yes

- iOS app: Yes

- Android app: Yes

Contacts

- Websites: https://apollofinances.com

- Email: [email protected]

- Address: Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshal Islands, MH 96960

- Telephone: +442030974723

FAQ

Is ApolloFinances a safe broker?

While CFD trading carries inherent risk, ApolloFinances appears to be a safe and reliable broker. The firm has its legal documentation and policies on display at its website, and is owned and operated by MGX Consalt Group Ltd, which is registered in the Marshall Islands under registration number 106986.

What are the deposit options for ApolloFinances?

There is a variety of ways to deposit funds into your account at ApolloFinances. You can use a bank transfer, most credit and debit cards (including Visa and Mastercard), or some third-party payment processors, depending on what is available in your country of residence.

How do I withdraw money from ApolloFinances?

Withdrawals are usually processed using the same payment method that you used to deposit. Withdrawals using a credit card are a little more complicated, as your original deposit will be withdrawn onto the credit card (as a ‘refund’), while any profits will be withdrawn as a wire transfer. If you do not place a trade, your original deposit can be refunded back to your debit or credit card. Wire transfer withdrawals incur a fee.

How do I open an account with ApolloFinances?

Go to the website and click on ‘Sign up’. You will need to fill in a few details to register for your account. You will then need to verify your account by submitting your government-issued ID and proof of residence. As soon as you are notified that your account has been verified, you can fund it and start trading.